For centuries, investments in real assets have played a key role in diversified portfolios. Today, with rising food demand and interest in sustainability, natural assets are more attractive than ever.

Canada’s agriculture sector ranks among the world’s leaders in wheat, canola, and soybeans. This draws international investors seeking stable, inflation-hedged, and sustainable portfolios.

At FIAN INC., we acquire premium Canadian farmland locally managed by our team, mainly for cereals, vegetables, and pulses, then leased back to farmers.

As asset managers, we supervise the farming operations and provide oversight of the investment. Returns are generated through:

Additional revenue opportunities may include:

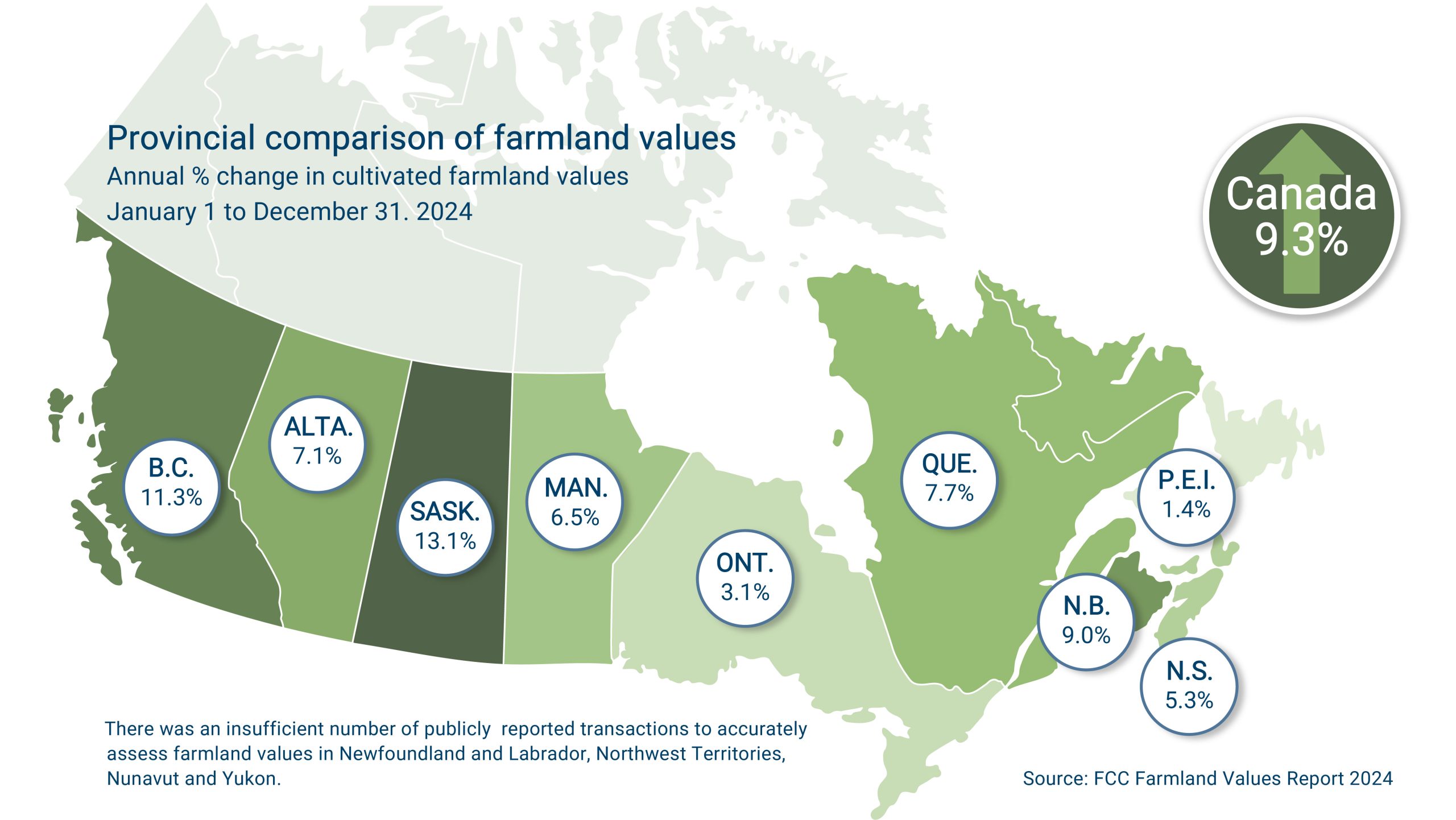

The average annual rate of appreciation of prime Canadian farmland varies from one province to another. According to FarmCredit Canada (FCC), the average appreciation for farmland in 2024 was 9.3% across Canada. A large part of our farmland assets under our management are located in Ontario, where the annual average land appreciation has been 7% over the last ten years.

Investing in Canadian farmland presents a range of opportunities and challenges. For foreign investors, understanding political, economic, and environmental factors, as well as tax implications, is crucial. To support informed decision-making, our research paper, “Investments in Canadian Farmland,” provides a comprehensive analysis of the opportunities and risks associated with farmland investments in Canada. It includes: